It’s all about something called “De Minimis Safe Harbor”…

What is “De Minimis Safe Harbor” & Why Should You Care?

De minimis safe harbor, allows you to deduct the entire expense of the cost of a single item rather than having to depreciate it over several years. Thus allowing a much bigger deduction for a qualifying purchase in a single year.

SOME GOOD NEWS: Effective for taxable years beginning on or after January 1, 2016, the Internal Revenue Service increased the “de minimis safe harbor” threshold from $500 to $2500 per invoice or item.

SOME IMPORTANT GUIDELINES:

- You can use the de minimis safe harbor to deduct the cost of an item you don’t use 100% of the time for business. Your deduction is limited to the dollar amount of your business use percentage.

EXAMPLE: Mark purchases a $1,000 computer he uses 60% of the time for business and 40% of the time for personal use. He can deduct $600 of the cost using the de minimis safe harbor.

- You may use the de minimis safe harbor only for items whose cost does not exceed $2,500 per invoice or $2,500 per item as per the invoice. If the cost exceeds $2,500 per invoice (or item), no part of the cost may be deducted.

EXAMPLE: Mark purchases for business use: • a computer for $1,200 • an office chair for $800, and• an office desk for $3,000. Mark’s total is $5,000. Each item qualifies except the desk. Mark may immediately expense $2,000 of the total using the safe harbor. He can’t use the safe harbor to deduct the $3,000 cost of the desk. Instead, he may depreciate the desk over five years.

- You cannot break into separate components property that you would normally buy as a single unit.

- If you sell the item you expensed the entire amount you realize from the sale is treated like ordinary income—that is, it is taxed at your normal individual tax rates not lower capital gain rates.

- You must include all additional costs included on the same invoice with the property—for example, delivery or installation fees.

- You can use the de minimis safe harbor even if your business earns no profit during the year.

- Deductions taken for the item are not subject to recapture if the item is later used over 50% of the time for personal use.

For IRS details on this topic click here

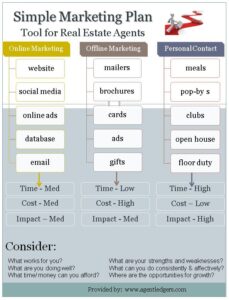

Our Products and Services:

** FREE tax deduction checklist for Real Estate Agents: click here

** bookkeeping software for real estate agents: www.agentledgers.com

** virtual bookkeeping services for real estate agents: www.myvirtualbookkeeping.com

Note: This is general information to help you gain an understanding of U.S. tax laws. I am not a tax attorney or tax preparer. Please consult a qualified expert when you are preparing your tax returns or making tax-related decisions.