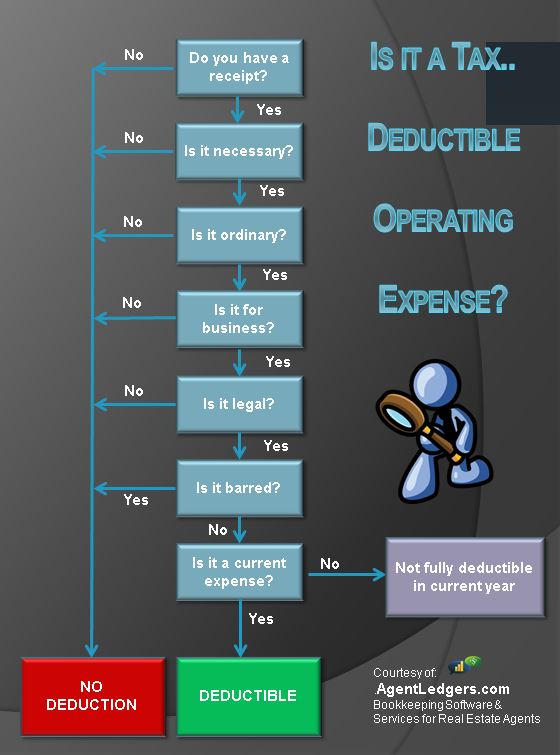

As a small business professional, there are many types and kinds of operating expenses. Rather than just list them all, it is best to understand the criteria of an operating expense.

A few tips to note:

Is It Ordinary? Is the expense common for your business? If you are claiming something highly unusual for your business expenses it may be flagged and questioned by the IRS. It is usually easy to identify the “ordinary’ expenses.

Is It Necessary? Consider if it is helpful and appropriate for your business. It does not have to be indispensable but it need only help your business.

A FEW EXAMPLES:

Sam a Real Estate Agent installs a Cappuccino machine in the office to serve clients coffee when they come by on appointments. Even though the coffee machine is not essential or indispensable it is “helpful” as some may value the coffee and may prefer it while doing business.

Jessica a Real Estate Agent claims a handgun collection because of having to go to potentially unsafe locations to show a property. Such expenses have been by viewed by the IRS as “extraordinary” rather than “ordinary” to the usual and customary business. For a case involving such a claim which involved other examples of disallowed deductions click here. (Samp v. Commissioner, TC Memo 1981-1986.)

Is It Business Related? An expense needs to be directly related to your business. Having lunch with a friend or relative where the primary motive is personal and not the business is not deductible. If you use your cell phone only 50% of the time for business and the rest personal, you can only claim 50% of the phone bill as a business operating expense.

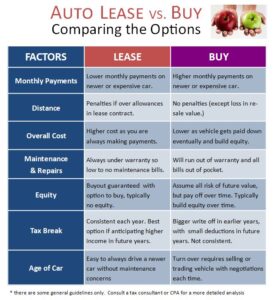

Is It A Current Expense? These are expenses that are fully deductible in the year you incur them. Some expenses that last for more than 1 year, such as Capital Expense Items, may need to be depreciated over a number of years. Such as a car purchase or other high priced items with a longer than 1-year benefit to the business. For IRS details on Capital Expenses click here.