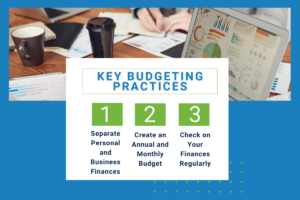

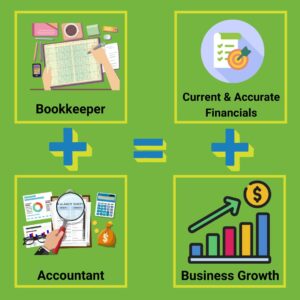

Here are 4 reasons to have a separate business account:

ONE: Makes bookkeeping much easier. You can easily complete bank reconciliations for your business when you do not need to wade through all your personal entries. Plus, you can easily download and import your business bank account data into your bookkeeping software program without all the extra data. This saves you bookkeeping time!

TWO: Allows for separate checkbooks. Sometimes it may be necessary to write a check, and in that case, you can clearly see which are business versus personal checks. Plus, the checks can be a different design and contain name and address or other information that best reflects your business. You may even be able to include your marketing slogan. After all, someone you do business with may become your next client?

THREE: Reduces the number of questions during an audit. Every business person should “assume” that it is not a matter of “if”, but a matter of when” you are audited. One of the things the auditor may be looking for is your bank statements. Mixing personal and business into one statement can lead auditors to ask you justify personal income items that were deposited into your account 4 or 5 years ago.

FOUR: Easier to deduct any interest or bank charge expenses. If you mix personal and business in one account you can only deduct bank charges on that account as a percentage of use. For example, if 80% of bank data is personal and 20% business, then you can only deduct 80% of the bank fees and any interest costs. This “splitting” becomes difficult at tax time. Simplify these kinds of expenses with separate accounts.

TIP: make sure if you are paperless, to print out a copy of your bank statements. Many banks will only archive the statements online for a period of 18 months or 24 months. If you have to produce the statements in 3 to 4 years during an audit, you will want the printed versions.