In the back of every business person’s mind is the potential for a tax audit. Don’t wait until that day comes, be prepared in advance and be familiar with the process and what can be expected.

Here are a few tips that may help:

What can trigger a tax audit?

- Tax returns with errors

- Random selection

- Business with recurring losses

- Signs of aggressive tax planning or non-compliance

- Standing out of the norm for the industry, colleagues, or neighbors.

How Will You Be Notified?

Should your account be selected for audit, you will be notified by mail. An IRS audit will not be initiated by telephone. So do not get caught in any tax scam via email or telephone.

How Long Will it Take?

Audits in which all requested documentation or a signed agreement is received can be closed quickly. Other types can take several months.

How Will Audit Be Conducted?

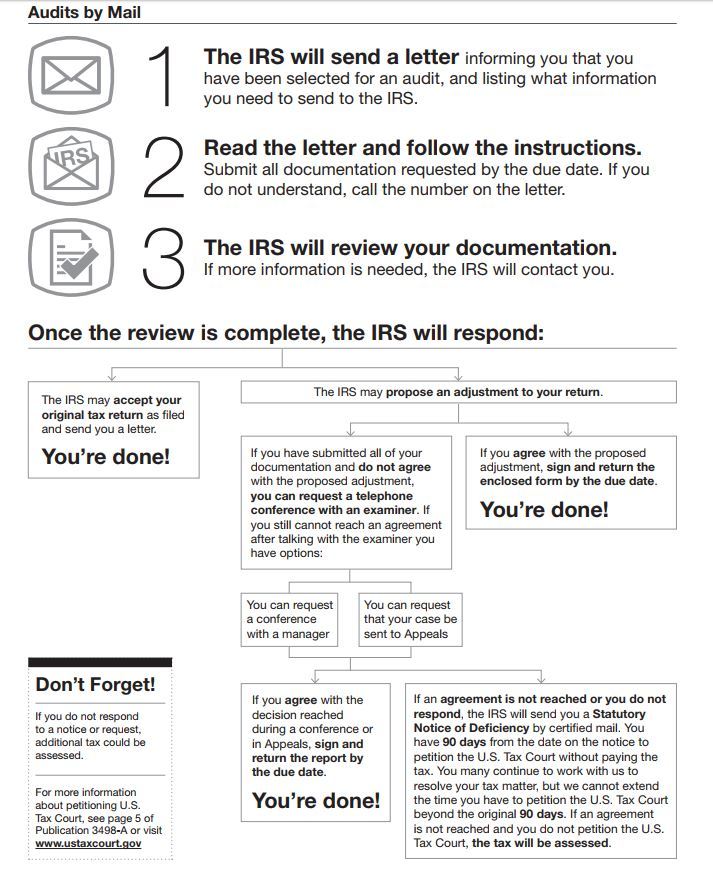

By Mail

By in-person interview – at either tax office or your home, CPA office, or place of business.

Here is a chart of how a “mail” audit can work:

What Do You Need to Provide?

The tax department will provide a written request for specific documents. Generally, the IRS can include returns filed within the last three years in an audit. If IRS identify a substantial error, they may add additional years. They usually don’t go back more than the last six years.

Here are the most common documents to have on hand:

Receipts – Present these by date with notes on what they were for and how the receipt relates to your business. In addition to providing the dollars paid or received for a service or product, certain kinds of receipts can prove mileage.

Bills – Include the name of the person or organization receiving payment, the type of service and the dates you paid them.

Canceled checks – Group these with copies of the bills they paid.

Logs or diaries – These might show the dates and locations of your travel as well as the business purpose and mileage.

For a more detailed list of documents, you may need to provide click here.

Tips for Success:

- Keep your financial records organized

- Be prepared and organized with the auditor

- Make the auditor’s job easy and pleasant

- If you seem prepared the impression will be positive instead of negative

- Ask questions and seek clarifications

- Hire a tax professional or attorney if audit is beyond your comfort level

Other Reference material:

Your Rights as a Taxpayer, Publication 1, pdf, IRS.gov

IRS Audits (an overview), IRS.gov